Background (what is blockchain)

Blockchain is notably the biggest technological innovation after the Internet. If you are a novice to the concept of blockchain or you are still struggling to get into its core you can read about in our previous articles where we speak about the technology in details.

To put it short, blockchain is all about trust, transparency, and traceability.

What makes blockchain so popular is the ability to be implemented in any kind of business having transactions (monetary or not), immutable record-keeping or programmable agreement (smart contract).

In our previous posts, we have outlined specific business cases where we can apply the technology. Most in-demand arias are:

At this stage, we can stay that we are still developing the infrastructure to onboard more and more sectors and businesses. It is safe to assume that blockchain applications will be driving the world in the next 10-15 years, helping companies to reduce costs and increase efficiency.

Real Estate Market

In this post, we are going to discuss the difficulties faced by the global real estate market and the potential of blockchain to help the market grow.

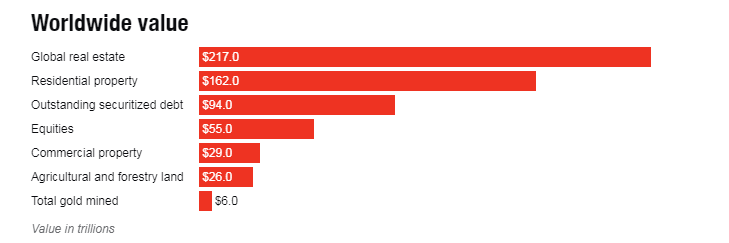

Global real estate worth all sectors combined represents the whopping $217 trillion. Mostly dominated by the wealthy and large corporations. Through the blockchain, more people will be able to access the market where transactions can now be made more transparent, secure, and equitable.

Real Estate Problems / Solutions

Platforms and Marketplaces

Currently, the property listing is done on multiple platforms, resulting in time-consuming and costly operations when one is in a search for the ideal industrial or private property. There are also issues with data accuracy because the listings are done depending on broker preferences. This lack of standardization is further complicating the search process.

Decentralized property record will enable fast and efficient property discovery. A blockchain-based system would enable data to be distributed across a peer-to-peer network in a manner that allows brokers to have more control over their data, along with increased trust.

Title records

Title records are another challenging-to-access aspect of the real estate buying/selling process. Even at the age of the Internet, title information remains stored at the local level and is offline. Blockchain can offer a new and more efficient way to to deal with this problem.

Blockchain could provide a central title database to securely store and instantly access historical title records, allowing for the streamlining of title transfer in a property sale.

Financial transaction

Buying, selling or renting a property has a cost. There are professional fees and commissions, inspections costs, registration fees, loan fees, and taxes associated with real estate. These costs even vary depending on the jurisdiction.

Payments and transaction done via banks and other intermediaries are slow and expensive. Especially when we are dealing with cross-border transactions.

Commercial Real Estate cash flow management

In commercial real estate, there are various actors involved in the renting/buying/ selling process. Vendors, landlords, tenants, and property managers all performing multiple transactions checks and verifications resulting in more complicated accounting. This is making the process not only slower but also costlier.

Smart contracts enable easier, transparent, and efficient property management and cash flow management.

Executing a real estate lease using smart contracts can address many of the challenges associated with property and cash flow management. The traditional lease contract can morph into a smart tenancy contract.The contract could use rent or bonds for automated payments to real estate owners, property managers, and other stakeholders along with near real-time reconciliation.

Blockchain transactions

Blockchain is allowing for fast, secure and cheap cross-border transactions. Besides improving the speed and price of transactions blockchain distributed immutable ledger could improve the accounting accuracy and ease the efforts.

Liquidity

There are hundreds of billions of dollars of commercial real-estate loans that need to be refinanced in the next three to seven years, but there are fewer lenders who will be able to provide that capital. Properties in smaller markets, those with substantial vacancies and properties with weak borrowers already are experiencing a shortage in the capital.

source

Blockchain and digital currencies are providing an innovative way to invest and to transact. Besides facilitating transactions, blockchain can allow for real estate to become more liquid. Property tokenization might be the next big thing for the sector allowing fractional ownership. A seller doesn’t have to wait for a buyer who can afford the whole property in order to get some value out of their property.

Additionally blockchain also lowers the barriers to real estate investing.

Conclusion

Blockchain technology can improve the real estate ecosystem by enabling all involved parties to securely and efficiently share data and money. It makes information more accessible, cuts out middlemen and reduces the risk of fraud and theft. A more secure, speedier, trusted process for buying and selling and property that is beneficial for everyone.

You have a project in mind? Get in touch with us at hello@hack.bg

Our team is here to help you from architecture design to a perfectly working solution.

Take a look at the full list of our services on our website.

We bring ideas to life.

Also published on Medium.