In a previous insight, we looked at bitcoin transactions and how do they work. Today we are going to dive deeper into one of the key components of bitcoin transactions – the fees!

Yes, even though bitcoin does not operate through middlemen, there are still fees that need to be paid and in this article, we are going to explain the core concept for their existence, how are they determined, where do they go and more.

Price is what you pay. Value is what you get.

Warren Buffett

Every bitcoin transaction must be added to the blockchain, the official public ledger of all bitcoin transactions, in order to be considered successfully completed or valid. So, when Satoshi Nakamoto created the Bitcoin blockchain, he implemented transaction fees in order to prevent spam transactions that could slow down and clog the network, either maliciously or out of ignorance.

Imagine if you were able to send a transaction without a fee – you could in theory send 100 million bitcoin transactions at the cost of just a bitcoin. The network can not handle this large number of transactions at once, which means it would take much longer for a transaction to be confirmed and processed. The transaction fee then forms a protection against these types of attacks.

The idea is not new, as Satoshi borrowed it from Adam Back’s 2002 iteration of hashcash.

These fees serve as a financial reward for the miners (powerful computers that spend vast amounts of computing power and energy to add the transactions on the blockchain) by incentivising them to keep validating transactions, helping support the network’s security and keeping the ecosystem running.

We say feeS, because miners reserve two types of rewards:

First, they receive a block reward. This is a fixed number of bitcoin, which is halved once every four years. At this moment (2022), a block reward is 6.25 bitcoin.

Secondly, miners receive a fee. This is the transaction fee that you give to the network. Because the block reward is halved every four years, the role of the transaction fee becomes increasingly important. In the distant future, this will be the only form of income for miners as we know there can only be 21 million bitcoins.

If you want to know what happens with the fees after the last bitcoin is mined – read our article.

So, the total fee is a sum of the transaction fees and block subsidy is the block reward.

Conceptually looked at, transaction fees are a reflection of the speed at which a user wants their transaction validated on the blockchain. When a miner validates a new block in the blockchain, they also validate all of the transactions within the block.

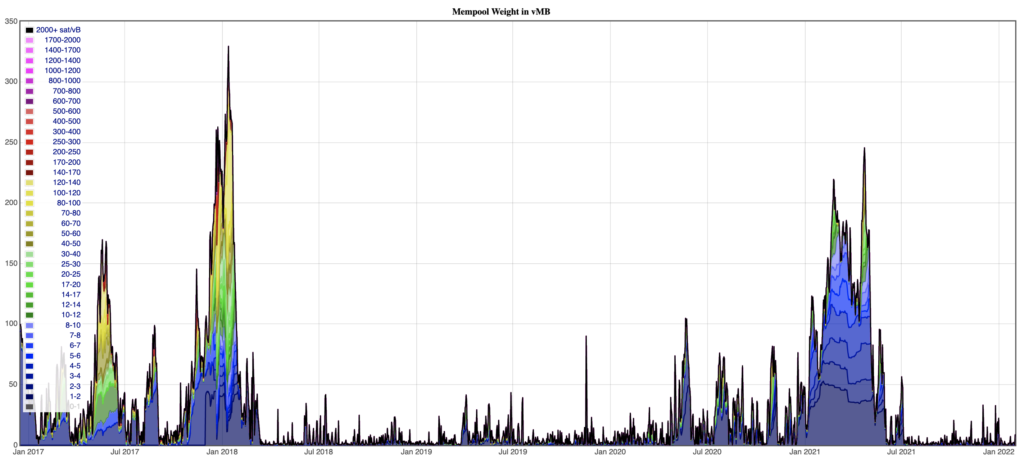

Because a block on the bitcoin blockchain can only contain up to 1 MB of information, there is a limited number of transactions that can be included in any given block. During times of congestion, when a large number of users are sending funds, there can be more transactions awaiting confirmation than there is space in a block. When a user decides to send funds and the transaction is broadcast, it initially goes into what is called the memory pool (mempool) before being included in a block. It is from this pool that miners choose which transactions to include, prioritising the ones with higher fees – a thoughtfully predicted ordering behaviour by Bitcoin’s creator based on the natural greed flaw/feature of human creatures. If the mempool is full, the fee market may turn into a competition: users will compete to get their transactions into the next block by including higher fees.

How are bitcoin fees determined?

Transaction fees are measured in satoshis/byte and are based on the data volume of a transaction and the congestion of the network. One satoshi equals 0.00000001 BTC (8 decimals, or 100 millionth of a bitcoin) and is considered the smallest divisible unit of bitcoin. More complicated the transactions (more inputs and outputs), means more data involved, hence more bytes, hence – more expensive the transaction.

In order for your transaction to be confirmed immediately, your optimal fee rate may vary significantly. However, if you do not mind waiting, paying 2 sats/vByte will usually allow your transaction to be confirmed within a day or a week.

Why Do Transaction Fees Go Up and Down?

Transaction fees depend on one key factor and that is the overall use of the Bitcoin blockchain. Basically, it’s a matter of supply and demand.

The mempool is where all the valid transactions wait to be confirmed by the Bitcoin network. A high mempool size indicates more network traffic which will result in longer confirmation time and higher priority fees. The mempool size is a good metric to estimate how long the congestion will last.

How much does Bitcoin network charge per transaction right now?

To calculate the appropriate fee for your transaction you will need to multiply your tx size with the fee rate required to enter the next block. You can predict the required fee rate from this page, however, the transaction size isn’t something you’ll be able to view beforehand.

Who gets the bitcoin transaction fee?

The Bitcoin transaction fee is paid to the miner who entered the transaction into a successfully mined block.

Tips to save on Bitcoin transaction fees

Use a wallet with a set fee

Bitcoin transactions happen through a crypto wallet — the software or hardware that allows you to store, send and receive bitcoin. Many popular, mainstream exchanges also have wallets and will calculate and pass on bitcoin transaction fees in real-time.

There are a variety of wallets that allow you to set your own fee — though that can mean that a transaction you wish to make may not be prioritized or go through immediately. This may not be important to you if you’re doing a small number of transactions or just one transaction, but the option may be valuable if you’re looking to save on Bitcoin transaction fees.

Use the Lightning Network

Bitcoin transactions are more expensive than many transactions that happen with fiat currencies. To fix this, a group of developers created the Lightning Network, a protocol that sits on top of the blockchain and allows users to transfer Bitcoin on daily basis much faster and with far lower fees than normal, “on-chain” transactions.

Keep track of the bitcoin fees

The first step to avoiding high bitcoin transaction fees is to track bitcoin transaction fees, through specially dedicated sites, and news coverages. So it’s possible to keep track of fees and wait to do a transaction when the fees are lower.

Final thoughts:

Every bitcoin transaction you make, comes with it a cost. You do not pay this cost for nothing. It maintains the decentralized Bitcoin network. It is intended as an incentive for miners and most importantly it exists to prevent spam attacks on the network. Without a transaction fee, malicious parties could send a large volume of transactions at little expense. Satoshi Nakamoto sacrificed speed for security and anyone who understands the true value of decentralization, should realise that this is a cost worth paying. Few.